Virtual Accounting Services

We Provide Virtual Accounting Services in UAE by Qualified Accountants at Affordable Fee.

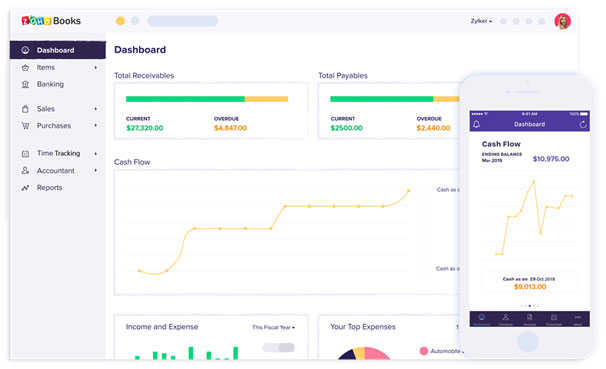

Virtual Accounting Using Zoho

We are authorized partner of Zoho and use Zoho Books an online cloud based accounting software that takes care of the accounting needs of your business. With the use of Zoho Books we are providing accounting, audit and analyze of all financial transactions seamlessly. Watch this video to get a glimpse into the different modules available in Zoho Books.

Benefits of outsourcing Accounting & Bookkeeping Services

Being a business owner or a manager for your company can sometimes mean you are the one keeping an eye on everything. Being responsible for your company’s success and making sure everything happens as you have envisioned, is a tough job that you do well. But there is one specific area that should be the same for all companies, something that is only correct without any creative input which is accounting. The Top of five benefits of outsourcing Accounting & Bookkeeping Services are:

Reduction in Business Costs

By outsourcing accounting and bookkeeping, business can reduce their operation cost and avoid the costs of hiring full time accountant. At the same time business can gain access to external expertise of qualified professionals that the business could not manage to pay for otherwise.

Increase in Productivity

By outsourcing accounting and bookkeeping, business owners/management can focus more on core income generating activities and can rest assured that the accounting responsibilities will be completed on time by the accounting experts.

Timely Compliances and Avoidance of Associated Penalties

Meeting all mandatory compliance requirements and avoiding associated penalties is another benefit of outsourcing accounting and bookkeeping. Businesses can gain peace of mind as qualified experts in the field of accounting will take care all of their statutory compliance requirements, such as filing of taxes and other statutory compliance requirements on timely basis

Access to Expert Advise

While hiring a full time accountant will be costly and scope of work of an accountant will be limited to accounting function. By teaming up with accounting firm, businesses can feel confident that only the most qualified experts are handling their finances in an unbiased and objective manner. Services are often tailored and scalable to bring you the right expertise at the right time for greater flexibility across the board.

Access to Right Information at Right Time

By outsourcing accounting function not only businesses can get their complete books of accounts but at same time businesses can gain access to right information at the right time to take bold business decisions. Like cash flow position of the company, financial ratios, top expenses of the company, expected payments from the customers, tax payments and many more.

Pricing

Simple and affordable pricing!

- Yearly Package (1 Month FREE) –

AED 5,499 ( Book & Pay Now ) - OUR PACKAGES INCLUDES

- Accounting Data Entry – Up to 100 Per Month

- Zoho Books Subscription – Basic

- Contacts (Customers/Suppliers) – Up to 50

- Users – 2

- Custom Domain – ✕

- Monthly Bank Reconciliation – ✔

- Monthly Financial Reports – ✔

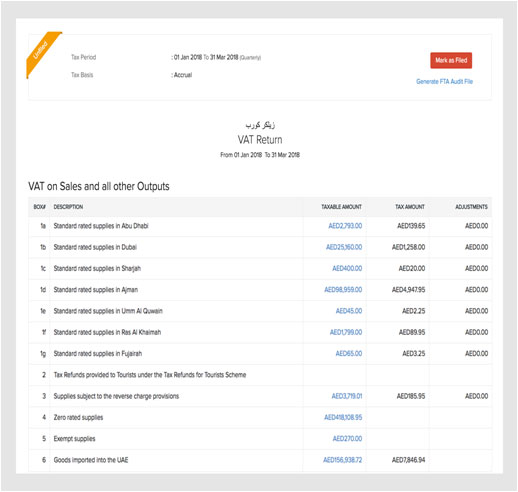

- VAT Return Filing – ✔

- VAT Advisory – ✔

- Accounting Advisory – ✔

- Financial Analysis – ✕

- Inventory Accounting – ✕

- Core Features

- VAT compliant Invoices – ✔

- VAT compliant Bills – ✕

- Estimates – ✔

- Time Tracking – ✔

- Expense Tracking – ✔

- Client Portal – ✔

- Budgeting – ✔

- Banking – ✔

- Credit Notes – ✔

- Vendor Credits/ Debit Notes – ✕

- Purchase Orders – ✕

- Sales Orders – ✕

- Delivery Challan – ✔

- Advance Features – ✔

- Payment Gateway Integrations – ✔

- Customized Invoices – ✔

- Sales Approval – ✔

- Purchase Approval – ✕

- Vendor Portal – ✕

- Stock Tracking (Including Price List, Opening Stock Tracking, Reorder Points, Landed Cost, SKU, Stock Adjustments) – ✕

- Multi-Currency – ✔

- Multi-lingual – ✔

- Reporting Tags – ✕

- Automation

- Recurring Invoice – ✔

- Recurring Expenses – ✔

- Recurring Bills – ✕

- Payment Reminders – ✔

- Integration with other Zoho Apps such as CRM, Inventory, Expenses, Subscriptions, Projects, Analytics etc. – ✕

- Access to Mobile App & Cloud Accounting Software – ✔

- Cloud Document Upload – ✔

- Yearly Package (1 Month FREE) –

AED 10,999 ( Book & Pay Now ) - OUR PACKAGES INCLUDES

- Accounting Data Entry – Up to 250 Per Month

- Zoho Books Subscription – Standard

- Contacts (Customers/Suppliers) – Up to 500

- Users – 3

- Custom Domain – ✕

- Monthly Bank Reconciliation – ✔

- Monthly Financial Reports – ✔

- VAT Return Filing – ✔

- VAT Advisory – ✔

- Accounting Advisory – ✔

- Financial Analysis – ✕

- Inventory Accounting – ✕

- Core Features

- VAT compliant Invoices – ✔

- VAT compliant Bills – ✔

- Estimates – ✔

- Time Tracking – ✔

- Expense Tracking – ✔

- Client Portal – ✔

- Budgeting – ✔

- Banking – ✔

- Credit Notes – ✔

- Vendor Credits/ Debit Notes – ✔

- Purchase Orders – ✔

- Sales Orders – ✔

- Delivery Challan – ✔

- Advance Features – ✔

- Payment Gateway Integrations – ✔

- Customized Invoices – ✔

- Sales Approval – ✔

- Purchase Approval – ✔

- Vendor Portal – ✕

- Stock Tracking (Including Price List, Opening Stock Tracking, Reorder Points, Landed Cost, SKU, Stock Adjustments) – ✕

- Multi-Currency – ✔

- Multi-lingual – ✔

- Reporting Tags – ✔

- Automation

- Recurring Invoice – ✔

- Recurring Expenses – ✔

- Recurring Bills – ✔

- Payment Reminders – ✔

- Integration with other Zoho Apps such as CRM, Inventory, Expenses, Subscriptions, Projects, Analytics etc. – ✕

- Access to Mobile App & Cloud Accounting Software – ✔

- Cloud Document Upload – ✔

- Yearly Package (1 Month FREE) –

AED 16,499 ( Book & Pay Now ) - OUR PACKAGES INCLUDES

- Accounting Data Entry – Up to 500 Per Month

- Zoho Books Subscription – Professional

- Contacts (Customers/Suppliers) – More Than 500

- Users – 10

- Custom Domain – ✔

- Monthly Bank Reconciliation – ✔

- Monthly Financial Reports – ✔

- VAT Return Filing – ✔

- VAT Advisory – ✔

- Accounting Advisory – ✔

- Financial Analysis – ✔

- Inventory Accounting – ✔

- Core Features

- VAT compliant Invoices – ✔

- VAT compliant Bills – ✔

- Estimates – ✔

- Time Tracking – ✔

- Expense Tracking – ✔

- Client Portal – ✔

- Budgeting – ✔

- Banking – ✔

- Credit Notes – ✔

- Vendor Credits/ Debit Notes – ✔

- Purchase Orders – ✔

- Sales Orders – ✔

- Delivery Challan – ✔

- Advance Features – ✔

- Payment Gateway Integrations – ✔

- Customized Invoices – ✔

- Sales Approval – ✔

- Purchase Approval – ✔

- Vendor Portal – ✔

- Stock Tracking (Including Price List, Opening Stock Tracking, Reorder Points, Landed Cost, SKU, Stock Adjustments) – ✔

- Multi-Currency – ✔

- Multi-lingual – ✔

- Reporting Tags – ✔

- Automation

- Recurring Invoice – ✔

- Recurring Expenses – ✔

- Recurring Bills – ✔

- Payment Reminders – ✔

- Integration with other Zoho Apps such as CRM, Inventory, Expenses, Subscriptions, Projects, Analytics etc. – ✔

- Access to Mobile App & Cloud Accounting Software – ✔

- Cloud Document Upload – ✔

OUR PROCESS

BOOKING OF REQUIRED ACCOUNTING PACKAGE

FREQUENTLY ASKED QUESTIONS (FAQ’S)

Which Accounting Software do you use?

We use Zoho Books cloud based accounting software to provide accounting services.

Do we get real time access to our books of accounts?

Ofcourse! You can access your books of accounts any time any where with web/app application and additionally you can create up to 10 user as well.

Is our business data is secure while outsourcing accounting with you?

Many people ask us this question. And rightly so; as we use most secure and safe accounting software Zoho Books to protect your data and Zoho has invested a lot of time and money to ensure that your information is secure and private. Zoho offer’s security on multiple levels including the physical, software and people/process levels; In fact your data is more secure than walking around with it on a laptop or even on your corporate desktops. Further, we sign a service agreement that includes non disclosure and confidentiality clause to protect your sensitive and confidential information.

If we didn’t continue the subscription then still can we access to accounting data?

Yes, you will have life long access to your data at no charge even you discontinue the subscription. You can also export you data in excel of pdf format or take backup of the data.

What does includes in a Transaction?

We consider Sales Invoices, Purchase Invoices and Expenses Invoices over AED 500 to count transactions for billing purpose.

Which Package we should choose?

If you are a startup and your monthly transactions are less than 100 & you don’t have more than 50 costumers/suppliers then you can go with our STARTER package. If your monthly transactions are more than 100 or your customers/suppliers are more than 50 then you chose our STANDARD package. If you are established business and your monthly transactions are more than 250 then you can chose our PREMIER package.

Do you will take care of our tax compliances?

Yes, In all of our accounting packages VAT/TAX return filing and consultancy by qualified Tax expert is included. We won’t charge extra for that.

Is it compulsory to keep Books of Accounts in UAE?

Yes, As per the Federal Law, maintaining proper books of accounts is compulsory in UAE and any violoation of the same will attract hefty penalties.

Which accounting reports we will get from you?

You will get Monthly Profit & Loss Account, Balance Sheet, Receivables and Payables Report, Cash Flow Report, Top Expenses Report. You will also have access to all reports on real time basis.

Now You can buy Virtual Accounting Service right now

If you are in search of the best Virtual Account Services here in Dubai, UAE the we at Star Storm is the best choice for you. We are registered Chartered Accountants here in Dubai.