The VAT rate in UAE 2026 remains at 5% but how you comply has fundamentally…

9 Important things about VAT in UAE

Here are the 9 important things business must know about VAT in UAE :

1) What is VAT and VAT rate in UAE ?

Value Added Tax is a indirect consumption based tax imposed on taxable goods and services at each step of supply chain. VAT implemented by UAE from 01 January 2018 at the standard rate of 5% on most of the goods and services and 0% on exports and specified goods & services.

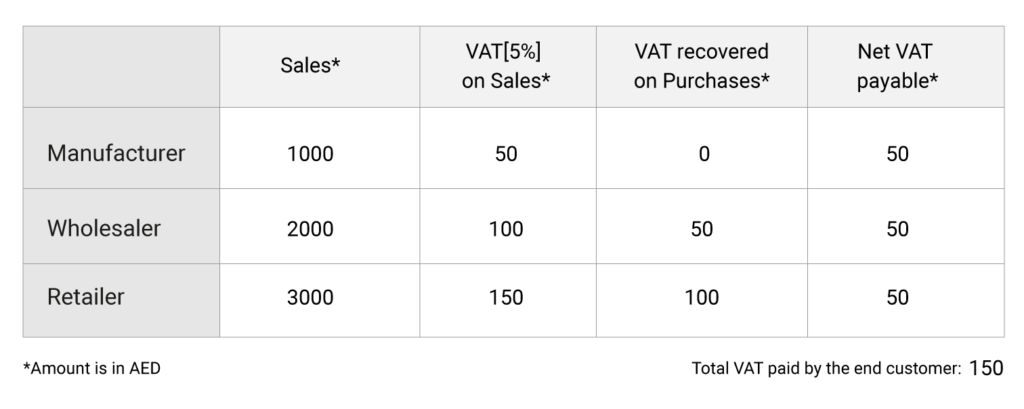

2) How does VAT works ?

A value added tax is applied at every stage of the sales process, and the registered business receives a refund (or tax credit) on the VAT paid at the previous step. It will be more clear with following table:

VAT Supply Chain

3) Who need to get registered under UAE VAT ?

A business must register for VAT if the taxable supplies and imports exceed the mandatory registration threshold of AED 375,000. Furthermore, a business may choose to register for VAT voluntarily where the total value of its taxable supplies and imports (or taxable expenses) is in excess of the voluntary registration threshold of AED 187,500.

To know more about VAT registration click here.

4) VAT return filing and compliance requirement ?

Registered business under UAE VAT need to file and pay their VAT returns as per their tax period allotted by Federal Tax Authority. Non compliance of the same will attract hefty penalties ranging from AED 1,000 to 300% of due VAT amount.

5) Accounting and Bookkeeping requirement as per UAE VAT law ?

The following records are required to be kept for at least 5 years to ensure accurate tax compliance:

Books of account

and any information necessary to verify entries, including, but not limited to: annual accounts; general ledger; purchase day book; invoices issued or received; credit notes and debit notes.

Additional records

required for specific taxes Different taxes may require different records to be kept in order for taxpayers to be compliant, for example, a VAT account.

Any other information

as direct by the FTA that may be required in order to confirm, the person’s liability to tax, including any liability to register.

6) Who is eligible to get Input VAT credit ?

If a buyer is a taxable person and also a VAT registrant, then they’re entitled to recover the tax incurred on the purchase of goods or services. A non-taxable person is generally not entitled to VAT recovery on any purchase. Input VAT on entertainment expenses, Vehicles used for personal purposes, some employee-related expenses, Supplies used to make exempt supplies are blocked for claim.

7) What is designated Zone for VAT purpose ?

Certain Free zones in UAE listed in a cabinet decision are excluded from VAT, these listed free zones are called Designated Zones. A designated zone in the UAE is ans area which is considered to be outside the UAE territiry for VAT purpose. Supplies made from inside or outside a designated zone are free of VAT (with some exceptions).

8) What is the Tax Invoice under UAE VAT ?

A Tax Invoice is a document which records the details of taxable supplies. A Tax Invoice must include – A unique sequential number, The date of issue, The supplier’s name, address and Tax Registration Number (TRN), The customer’s name, address and Tax Registration Number (TRN), Description of goods or services supplied, Total amount excluding VAT, Total VAT chargeable, Price and quantity of each item, Rate of discount per item, Rate of VAT charged per item – if an item is exempt or zero-rated, then mention there is no VAT on these items, Total amount including VAT.

Example of Tax Invoice as per UAE VAT Law

9) What is VAT Grouping ?

In UAE group companies or companies who full fills tax group requirements as prescribed by Federal Tax Authority can get one Tax Registration Number (TRN) for all group companies and file one VAT return for whole group. Also transactions between group companies will be outside scope of VAT.

If You’ve got questions, and we have answers. Just send us a message and one of our knowledgeable support staff will be in contact with you within 48hrs – even on weekends and holidays.

GET IN TOUCH WITH US TODAY: https://starstormuae.com/contact/