Accounting and bookkeeping services in Dubai are no longer optional for startups they are a…

How To Prepare UAE E-Invoicing 2025 for B2B & B2G

UAE started implementing the new e-invoicing for both business to business and business to government services in UAE by the mid of 2025. And these changes will fully be implemented to operation by the start of 2026 and it is mandatory to follow as well.

The UAE government is doing this as part of the FATOORAH initiative by the Federal Tax Authority (FTA).

To match the global e-invoicing system UAE is also going to implement it soon and businesses across the country have to follow as well.

What is E-invoicing in Dubai UAE ?

As we already know, e-invoice is the invoice generation through electronics mode and can be stored and managed all electronically.

So, this will reduce work load to manage the invoices made by paper and manage it easily.

Which Business Need e-invoicing in UAE

If you are not sure if your company needs to enforce this e-invoicing rule or not, then you must know that e-invoicing is mandatory for all the businesses, yes those in freezones as well, if they are VAT registered.

Apart from VAT, businesses in supply to government bodies and business to business transactions come under this rule.

So, almost all the businesses who are registered under the VAT are needed to use e-invoicing when implemented on full force.

Importance of E-invoicing in UAE

E-invoicing not only saves a lot of time for a business owner or the accounting team, but also is efficient and convenient.

Record maintenance to invoice generation it is quite easy and fast to complete the task.

How Dubai’s E-invoicing System Works

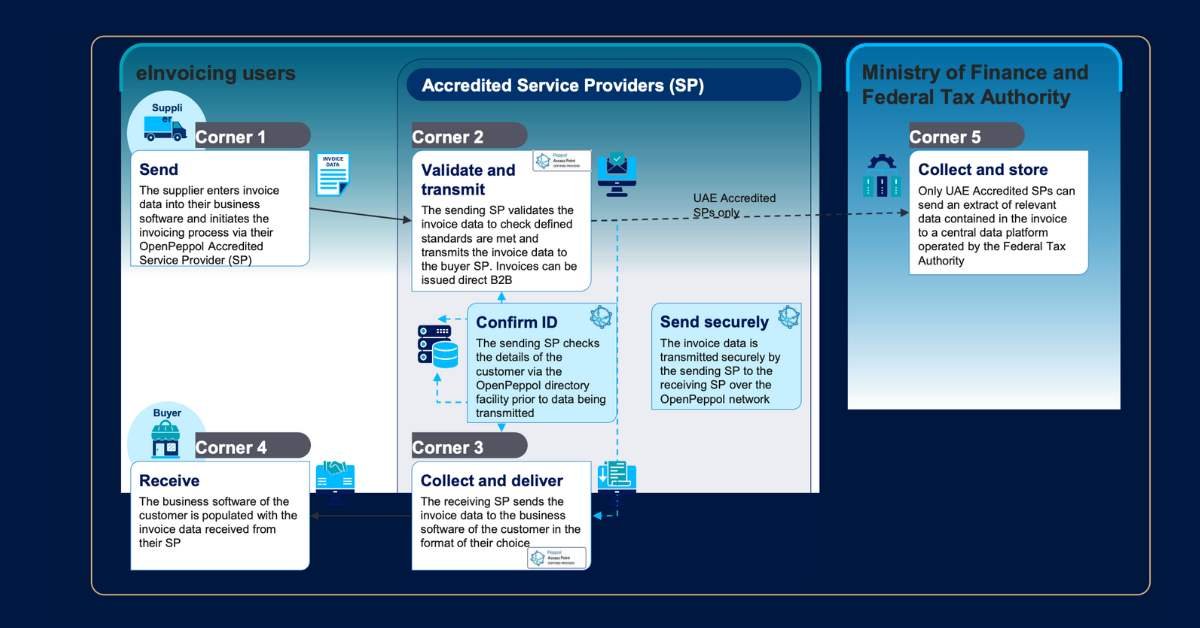

UAE has a very detailed e-invoicing framework and they call it the 5 corner framework.

Here are the 5 corner of e-invoicing:

Corner 1 Supplier : Through OpenPeppol, suppliers create e-invoice to its customers from popular softwares such as SAP, Zoho & QuickBooks.

Corner 2 Accredited Service Providers (SP) : After the supplier creates the invoice, their UAE-approved Service Provider (SP) confirms the buyer’s details, validates the invoice for compliance, and securely sends it to the buyer’s SP via the OpenPeppol network.

Corner 3 : The buyer’s service provider receives the invoice and delivers it to the buyer’s accounting system in the format they prefer.

Corner 4: Now, the customer’s accounting software automatically fills in the invoice details sent by their service provider.

Corner 5: UAE-accredited service providers are allowed to send key invoice data to the Federal Tax Authority’s central platform, which is where the government receives and processes the information. Image source

E-invoicing Benefits to UAE Business

E-invoicing has its benefits for the business owners in UAE. It tracks every transaction and gives an idea of all the financial transactions in and out of the business. Automation on e-invoice gives business the edge over time management.

How to implement E-invoice on UAE Business

- Get the e-invoicing software like Zoho Books.

- Fill up the information required for e-invoicing such as VAT details

- Train your employees to use the software

- You can add customer data on it

- Add your services or inventory

- Use it for invoicing and send to the customers

If you need help with e-invoicing here in Dubai UAE, we at Star Storm will help set it at your office or business address. You can just give us a call or a simple message on whatsapp.